Do you want EV news in your mailbox every week – SUBSCRIBE

Here’s a comprehensive snapshot of the latest EV business developments right now (as of today, 23 Feb 2026) — covering strategic corporate moves, market dynamics, infrastructure, and regulatory shifts:

🚗 Major OEM & Automotive Industry Moves

🔥 Volvo Cars recalls 40,000 EVs due to battery fire risk

- Volvo has announced a global recall of more than 40,000 EX30 electric SUVs because of potential battery overheating and fire hazard.

- Affected vehicles include both single-motor and twin-motor variants.

- Owners are being advised to limit battery charge to 70% until replacements are done.

- Estimated cost: ~$195 million for the recall itself — excluding labor, logistics, or longer-term brand impact.

- Impact: Share price fell ~4%, spotlighting safety as a critical EV business risk and a possible drag on adoption in safety-sensitive markets. (Reuters)

🚖 Uber invests in robotaxi charging hub infrastructure

- Uber announced a $100 million strategic investment to build charging hubs dedicated to robotaxi fleets (autonomous EV taxis).

- First phase will deploy in U.S. cities including Bay Area, Los Angeles, Dallas — with expansion planned globally.

- Partnerships include charging networks like EVgo; this aims to solve a major bottleneck in EV robotics deployment.

- This represents a next-gen charging infrastructure business model rather than consumer retail charging expansion. (Autoweek)

🚙 Maruti Suzuki (Suzuki) launches first EV with battery rental model

- India’s largest automaker (via Maruti Suzuki) introduced the eVITARA SUV, priced competitively (~$12,100).

- Crucially, it offers a battery rental scheme to reduce upfront cost barriers — a model gaining traction in emerging EV markets.

- The battery rental cost is structured per km, estimated to be roughly half the operating cost of equivalent ICE vehicles in India.

- Market context: EV share in India ~5% of total car sales but doubling YoY with support from domestic policy goals targeting 30% adoption by 2030. (Reuters)

🔋 Battery & Supply Chain Dynamics

🌍 Indonesia tightening control on critical nickel — supply chains affected

- Indonesia is cracking down on nickel mining and licensing, even as global demand and supply negotiations with the U.S. and China are evolving.

- While the country had dominated raw nickel supply (important for EV batteries), Chinese manufacturing shifts toward LFP chemistries reduce nickel demand.

- Policy volatility and regulatory enforcement may deter foreign investors and disrupt battery raw-material flows. (AP News)

🔄 EV battery lifecycle innovation: OMC Power + Honda partnership

- A new initiative to repurpose retired EV batteries into stationary energy storage solutions for homes and rooftop solar — part of broader second-life battery downstream markets.

- A sign of growing business ecosystems around battery reuse and sustainability, beyond initial vehicle use. (The Times of India)

📉 Market & Competitive Context

📊 Polestar doubles down on pure EV strategy amid financial strain

- Swedish EV brand Polestar (Geely-backed) reports significant financial losses (~$8 billion since inception) and slow demand, especially in the U.S.

- Rather than pivot to hybrids, Polestar is doubling its EV portfolio and securing external financing to fuel growth.

- Strategic risk: premium EV pricing + competition from lower-cost Chinese OEMs. (thescottishsun.co.uk)

📈 Startup / Small Business Momentum

- Indian EV ecosystem shows grassroots growth: reports highlight Battery Smart scaling in the EV services space, focusing on battery-swaps and last-mile electrification business models. (financialexpress.com)

📡 Macro EV Market Trends & Context

📈 Consumer sentiment hitting new highs

- According to the latest JD Power EVX study, EV owner satisfaction is at a record high, driven by advances in battery tech, vehicle performance, and charging experiences — a key signal for sustained long-term adoption. (wardsauto.com)

⚠️ Charger infrastructure growth still uneven

- Global charging build-out continues, but expansion rates vary regionally: Europe/EU are leading coverage, but structural gaps remain, especially in rural zones and emerging markets.

- Overall public charging points are rising sharply, with >30% annual increases in installed network capacity. (IEA)

📉 Broader industry pressure & strategy reassessment

- Recent industry analyses indicate stalled EV demand in some developed markets has led legacy automakers to reassess investments — even acknowledging $50 billion+ write-downs and strategic pivots toward hybrid/ICE and storage sectors. (tlimagazine.com)

🌐 Regional & Policy Headlines Still Shaping the Global EV Business

While not today’s headlines, these broader contexts influence the EV landscape:

- Canadian EV target policy likely scrapped, shifting toward fuel efficiency standards. (Reuters)

- Charging network alliances (e.g., IONNA in North America) aiming for tens of thousands of high-power charging points. (Wikipedia)

- Latest forecasts project exponential EV market growth through the 2030s, with multi-trillion-dollar market valuations. (altenergymag.com)

Summary – Key Themes Right Now

- Safety and quality issues (Volvo recall) are immediate disruptors.

- Infrastructure innovation expands beyond public chargers (e.g., robotaxi hubs).

- Affordability plays a role in emerging markets (battery leases).

- Supply chain geopolitics matter for critical minerals.

- Automakers face economic recalibration amid slower demand.

- EV satisfaction and battery reuse sectors signal future business growth.

Polestar future models….

Here’s what’s hottest right now in EVs across Nordics, Europe, England, Asia, and the US—focused on new models, batteries, charging, and self-driving.

Here’s a fresh, up-to-date news and “hot takes” snapshot (Feb 2026) on the EV market, charging, infrastructure and industry shifts in the Nordics, EU, Asia, and US — covering market performance, strategic shifts, regulatory action, charging network moves, and emerging technologies.

🌍 Overall EV Industry Momentum & Market Trends

1) Electric vehicle registrations showed a mixed global performance

- Global EV registrations dipped slightly 3% year-on-year in January 2026 (~1.2M units), driven by slower sales in China and the U.S. amid shifts in subsidies and taxation. Europe still posted growth. (Reuters)

2) Market leadership reshuffles

- BYD overtook Tesla in global EV unit sales for 2025, with ~2.26 M EVs delivered vs Tesla’s ~1.64 M, illustrating how volume across price segments is becoming critical. (Discovery Alert)

3) Industry financial impact from EV strategy revision

- Major OEMs have taken ~$65 billion in write-downs as some reevaluate EV commitments in light of slower adoption and policy uncertainty — particularly in the U.S., where EV share projections have been cut sharply under changing regulatory environments. (Financial Times)

4) National EV support scales up in parts of Europe

- Spain announced a €700 M program to boost EV adoption and expand charging infrastructure in underserved regions — combining purchase incentives with charging rollout funding. (The Times of India)

🇳🇴 Nordics – EV Adoption & Charging Infrastructure

Nordic EV market nuance

- Nordic EV adoption remains high but dynamic: Denmark’s car market grew in early 2026 and saw continued electric demand, while Norway’s new registrations declined in Jan 2026 due to fiscal timing effects (rule changes impacting purchase behavior). (alternative-fuels-observatory.ec.europa.eu)

Regional strength

- Norway, Sweden, Denmark, and Finland remain among the fastest EV adopters globally, with high market shares connecting policy, incentives, and charging networks. (wri.org)

Charging market moves

- Virta’s acquisition of Swedish fleet platform Northe consolidates Nordic charging software and driver services, aiming to create the region’s largest integrated EV driver platform — reflecting consolidation and B2B network strategy. (EV Infrastructure News)

🇪🇺 EU – Regulation, Charging Rollout, and Industry Strategy

EU industrial policy tightening

- The European Commission is proposing a “70% local content rule” for EV manufacturers to qualify for subsidies, pushing more European battery and component sourcing — a strategic move to foster domestic EV supply chains and reduce dependence on imports. (Financial Times)

EV market growth dynamic

- Europe started 2026 with a ~24% increase in EV unit sales (January), supported by recently reactivated subsidies in core markets like Germany, France and the UK — though overall adoption remains uneven across member states. (Benchmark Mineral Intelligence)

Charging infrastructure expansion

- Global public charging points saw >30% growth in 2024, with Europe crossing 1 million public points — driven by national deployment and policy frameworks like the Alternative Fuels Infrastructure Regulation (AFIR) pushed by Brussels. (IEA)

🇨🇳 Asia – China, India and Regional Charging Expansion

China’s electric transition scale

- China leads EV adoption in absolute terms globally and continues dominating public charging deployment — roughly two-thirds of global chargers added recently. (IEA)

India’s charging network consolidation

- JBM Group signed an exclusivity deal to acquire Fortum India’s EV charging arm (GLIDA, ~850 chargers) — a sign that local players are scaling networks across cities and highways to support growing EV demand. (mint)

Regional export and assembly moves

- African markets like Nigeria and Kenya are assembling EV vans domestically from Chinese kits and pairing them with solar-oriented charging efforts — illustrating Chinese tech’s export influence and localized charging ecosystem formation. (AP News)

🇺🇸 United States – Policy Focus & Charging Transition

Policy & infrastructure strategy

- U.S. EV policymakers are examining ways to reinvigorate EV charging deployment, including revitalizing the Joint Office of Energy and Transportation (JOET) and tying public investment to affordability/price controls — reflecting a shift toward targeted, economically “meaningful” deployment in challenging areas. (energypolicy.columbia.edu)

Broader market slowdown

- The U.S. EV market has seen significant sales declines (noted in the global January 2026 drop), prompting adjustments in strategy by both automakers and policymakers. (Reuters)

🔌 Charging Market Dynamics & Emerging Sub-Segments

Global infrastructure market projection

- The EV charging station market is forecast to expand tremendously over coming decades — with some analyses suggesting growth from ~$64 billion in 2025 to a multitrillion-dollar market by 2050 as electrification scales and charging becomes core infrastructure. (GlobeNewswire)

Vehicle-to-Grid (V2G) and bi-directional momentum

- The V2G market is set to grow at ~18.5% CAGR through 2033, with investments in bidirectional chargers and grid integration reflecting demand for smart energy and grid services from EV fleets. (prnewswire.co.uk)

Emerging flexible charging solutions

- Growth in mobile energy storage charging vehicles (battery-equipped vans/trucks that can charge EVs off grid) is being tracked as a new niche — addressing charging deserts and emergency power use cases — though at slower rollout/higher cost than fixed sites. (intelmarketresearch.com)

📊 What This Means Today

Market:

- The EV transition is no longer “linear growth only” — regions diverge as incentives, policy, and economic context shift.

- China remains the largest single contributor to EV uptake and charging deployment, but Europe and the Nordics push policy and infrastructure scale, while the U.S. navigates slower demand and infrastructure strategy.

Charging:

- Rapid public charger growth continues, but quality (uptime, payment, interoperability) and next-gen technologies (V2G, bidirectional charging) are becoming strategic differentiators.

- Consolidation (platform M&A, network alliances) and flexible charging formats (mobile solutions) are emerging trends.

Technology & Strategy:

- Across regions, regulatory frameworks (EU local content rules, U.S. infrastructure strategy), incentives, and market competition (Chinese OEMs scaling volume) are reshaping where and how EVs and charging systems will expand through the rest of 2026 and into the late decade.

Here’s what’s hot right now (as of Feb 9, 2026) on EVs, batteries, and charging across the Nordics, Europe, Asia, and the US—focused on the stuff that’s actively changing markets and user experience.

The hottest global themes (the “why it matters” layer)

1) Charging is becoming regulated infrastructure, not a “nice-to-have”

- In European Union, the AFIR regime is pushing minimum corridor coverage, ad-hoc payment, and clearer price transparency—moving public charging closer to “fuel retail rules.” (ICCT)

- In the United States, public fast charging still expanded hard in 2025 even with a bumpier EV demand curve—~18,000 new DC fast ports added in 2025 per reporting, taking totals to 70,000+. (Axios)

2) Battery compliance is now a product feature

- The EU Battery Regulation (2023/1542) is forcing manufacturers to treat traceability + lifecycle data as “table stakes,” with battery passports becoming mandatory from Feb 18, 2027 (for EV and certain industrial batteries). (eur-lex.europa.eu)

- Net effect: expect more talk about carbon footprint declarations, origin of materials, repairability, and recycled content—not just kWh and 10–80%. (eur-lex.europa.eu)

3) Heavy-duty charging is entering the “megawatt era”

- MCS (Megawatt Charging System) is moving from lab/spec sheets into real-world pilots and endurance runs (1,000A-class and beyond, aimed at long-haul truck duty cycles). (Scania Corporate website)

Nordics (Norway/Sweden/Denmark/Finland): “EV normality” + heavy-duty acceleration

Norway: ICE collapse is no longer theoretical

- January 2026 registrations reportedly included only seven new petrol cars—a headline-level milestone showing how close Norway is to “endgame” for new ICE sales. (The Guardian)

Sweden: fleet electrification + charging funding (esp. heavy vehicles)

- Sweden hit ~15% EV share of the car fleet in 2025 (EAFO reporting), while electric heavy trucks grew strongly (still small absolute numbers). (alternative-fuels-observatory.ec.europa.eu)

- Sweden-specific incentive/infra notes tracked by EAFO include support programs like Ladda Bilen and new heavy-vehicle charging funding streams (depots/corridors/TEN-T oriented). (alternative-fuels-observatory.ec.europa.eu)

Denmark and Finland: MCS pilots are landing

- Public/early MCS activity in the Nordics is expanding (examples include Sweden/Denmark pilots and new Finland buildouts reported by industry sources). (Kempower)

Practical takeaway for Nordic drivers/fleets: the region is shifting from “build more chargers” to “build the right chargers”—reliability, ad-hoc payment, uptime, and heavy-duty corridor power.

Europe: AFIR enforcement + Plug&Charge readiness becomes a differentiator

AFIR is turning into “enforcement reality”

- The EU’s own Q&A clarifies expectations around payment cards for ad-hoc charging and consumer transparency. (Mobility and Transport)

- Market commentary is increasingly about how regulators will test and enforce these requirements in practice. (evcharging-infrastructure.com)

Plug&Charge roadmap is becoming more explicit

- EAFO notes ISO 15118 support requirements ramping over time (including ISO 15118-20 later), which matters for Plug&Charge and secure automated charging experiences. (alternative-fuels-observatory.ec.europa.eu)

Battery Passport is the big compliance clock

- Battery passports from Feb 18, 2027 are a concrete deadline that will affect OEMs and potentially what consumers can see (battery provenance, sustainability claims, etc.). (Baker McKenzie)

Practical takeaway in Europe: “best charging network” will increasingly mean compliant + easy to pay + transparent + interoperable, not just “most stalls.”

Asia: sodium-ion momentum + safety regulation tightening + demand/price dynamics

China: sodium-ion is back in the near-term product timeline

- Reporting on Feb 9, 2026 says BYD has developed sodium batteries with very high claimed cycle life, and that CATL + an automaker have unveiled a sodium-ion passenger vehicle targeted for mid-2026. (CnEVPost)

- Why this matters: sodium-ion can reduce dependence on certain materials and is attractive for cost-focused segments (tradeoffs vs energy density).

China battery safety regs are getting stricter (effective July 2026)

- Battery safety standards are set to tighten with more demanding tests aimed at thermal runaway/fire risk reduction. (Reuters)

China market pulse: demand + competition are shifting

- **Tesla China-made EV sales rose YoY in Jan 2026, while broader market growth slowed sharply vs 2025, per reporting. (Reuters)

- BYD’s Jan 2026 domestic sales reportedly fell sharply YoY amid subsidy and price-war dynamics, reinforcing the push for overseas growth. (Investors)

India: policy is pushing charger rollout economics

- India has reportedly cut benchmark prices for EV chargers to accelerate deployment (and reduce subsidy burden), while infrastructure gaps remain uneven by state. (The Economic Times)

Practical takeaway in Asia: watch (1) sodium-ion commercialization, (2) safety regulation (esp. thermal runaway tests), and (3) continued price pressure pushing faster tech cycles.

United States: NACS transition + infrastructure scale continues

NACS is still the biggest connector story

- Tesla continues positioning NACS as the default path, with broader network opening as automakers transition. (Tesla)

- Automaker “who’s switching when” remains a moving target, but 2025–2026 model-year strategies increasingly include native NACS ports or OEM-approved adapters (industry reporting). (MotorTrend)

Public fast-charging expansion stayed strong in 2025

- Reporting indicates major expansion in DC fast charging ports and improving reliability/standardization trends. (Axios)

- Separate industry reporting pegged 2025 at record fast-charging sessions and improved reliability. (paren.app)

Policy volatility remains part of the US EV equation

- Consumer-facing incentives and edge cases (like leasing structures) have been under active discussion/changes in 2025–2026 coverage—worth validating at purchase time. (Kiplinger)

Practical takeaway in the US: plan for connector transition complexity (NACS ↔ CCS via adapters) through at least the next couple model years, but the infrastructure base is still scaling.

Heavy-duty & freight: the “next wave” that will reshape corridors (EU + Nordics + global)

- **Mercedes-Benz Trucks ran a 2,400 km endurance test (Germany→Sweden) with megawatt charging/MCS in Jan 2026, highlighting that public/private truck-ready infrastructure is now being used in realistic operations. (Daimler Truck)

- **Scania frames MCS as up to ~1,000A (and evolving), meant to make long-haul electric operations viable. (Scania Corporate website)

Battery tech watchlist (near-term vs longer-term)

Near-term (shipping now / 2026–2027 programs)

- Sodium-ion: renewed push toward mainstream segments in China (claims + prototypes targeting mid-2026). (CnEVPost)

- Safety-first packs: more stringent regulatory tests (China July 2026) will likely influence pack design, thermal management, and validation. (Reuters)

- Battery passports / traceability: EU compliance clock changes procurement, documentation, and supplier selection. (Baker McKenzie)

Longer-term (premium-first, then down-market)

- Solid-state remains “close, but not mass” — a US program aims to integrate Factorial tech into a production-intent vehicle around 2027, per reporting. (Autoweek)

If you want, I can turn this into a weekly “Hot EV + Battery + Charging” briefing split by region (Nordics/Europe/Asia/US) with the 10 most important items, each with why-it-matters and who-it-impacts.

The Times of India

Below is a hot + latest (as of 1 Feb 2026) briefing on EVs, batteries, and charging across the Nordics, Europe, Asia, and the US—focused on what’s materially changing right now.

What’s hot globally right now

Charging infrastructure is the new bottleneck (and the new battleground)

- Public fast-charging rollout is lagging policy targets in parts of Europe/UK, with operators citing grid constraints, planning friction, and policy uncertainty—especially around rapid chargers. (Financial Times)

- “Battery-backed chargers” (onsite storage paired with DC fast charging) are being used to bypass grid upgrade delays and smooth peaks—showing up as a pragmatic, near-term fix for constrained sites. (EV Charging Europe)

Standards are diverging by region (but converging within North America)

- In the US, the shift toward NACS continues: automakers are moving to native NACS inlets and leaning on adapters for legacy vehicles (a big deal for customer experience and utilization of existing networks). (Toyota USA Newsroom)

- Meanwhile, tracker data indicates both NACS and CCS connector counts grew strongly over 2025, with CCS still adding a large absolute number of connectors—so the transition is not “overnight.” (EV Charging Stations With Tom Moloughney)

Battery tech headlines: faster charging + safer chemistries + solid-state hype moving closer

- A flurry of headlines are clustering around solid-state / semi-solid readiness claims and higher energy density announcements; one example is Geely talking up a production-ready solid-state roadmap. Treat timelines cautiously, but it’s clearly back in the center of OEM messaging. (TechRadar)

- Separately, materials/process innovations aimed at meaningfully faster charging (without destroying cycle life) are getting attention—often framed as enabling higher C-rate charging. (Forbes)

Nordics: adoption leadership + fresh policy levers

Norway: effectively “post-ICE” for new car sales

- Norway hit ~96% BEV share in 2025 and ~97.6% in December 2025 (with year-end pull-forward dynamics tied to tax changes). (Reuters)

Sweden: new EV support starts March 18, 2026

- Sweden launches Elbilspremien with 1,300 SEK/month for up to 36 months (total 46,800 SEK) plus a potential 18,000 SEK start supplement for the lowest-income households. (naturvardsverket.se)

Why it matters: it’s structured to reduce monthly cost (useful for private leasing affordability), not just a one-off purchase bonus.

Europe: EV sales momentum + industrial policy tightening

Sales and regulation

- In Europe, EV sales surged in 2025 and EVs overtook petrol in December (monthly share), signaling mainstream momentum—despite brand reshuffling and continued subsidy/policy debates. (Financial Times)

“Made-in-Europe” rules and procurement push

- The European Union is preparing rules that would push EU-made content requirements for certain public purchases of green tech (including batteries/EV supply chain components). This can affect pricing, sourcing, and which battery packs qualify for public tenders. (Reuters)

Infrastructure: data and targets are getting more formalized

- The European Alternative Fuels Observatory continues publishing updated charging/vehicle datapoints and policy tracking—useful for benchmarking Nordics vs. EU averages. (alternative-fuels-observatory.ec.europa.eu)

Asia: scale + rapid iteration (and exports shaping everyone else’s market)

China: pivot from price war to “high-tech” positioning

- Coverage points to China’s market shifting emphasis toward higher-end tech (fast charging, battery swapping, and next-gen chemistries), with big players scaling infrastructure and pack tech to support it. (EV Infrastructure News)

Global market pressure via low-cost models

- Multiple regions are seeing adoption acceleration partly driven by cheaper models—often from Chinese OEMs—expanding the addressable market beyond early adopters. (The Guardian)

US: fast-charging expansion + NACS rollout moves from “promise” to “construction”

Network growth

- Reporting indicates US fast-charging expansion had its strongest year yet, with buildout led largely by private networks (important context for utilization and pricing). (Yahoo Autos)

OEM + network execution examples

- Toyota says NACS access expands DC fast-charging availability for its customers (adapters first, native inlets on newer models). (Toyota USA Newsroom)

- EVgo is actively deploying NACS ports, highlighting how quickly the ecosystem is retooling at the station level. (InsideEVs)

Practical “watch list” for the next 30–90 days

- Chargepoint reliability + pricing (especially HPC corridors): uptime and transparent pricing will increasingly decide brand loyalty.

- Grid-constrained sites: battery-buffered charging hubs will spread where connection queues are long. (EV Charging Europe)

- Battery safety and recalls: any OEM guidance limiting max charge state is a serious signal to watch (even if incidents are rare). (The Sun)

- Policy changes: Sweden’s Elbilspremien and EU procurement content rules may shift demand and supply patterns quickly. (naturvardsverket.se)

The SunBelow is a hot + latest (as of 1 Feb 2026) briefing on EVs, batteries, and charging across the Nordics, Europe, Asia, and the US—focused on what’s materially changing right now.

What’s hot globally right now

Charging infrastructure is the new bottleneck (and the new battleground)

- Public fast-charging rollout is lagging policy targets in parts of Europe/UK, with operators citing grid constraints, planning friction, and policy uncertainty—especially around rapid chargers. (Financial Times)

- “Battery-backed chargers” (onsite storage paired with DC fast charging) are being used to bypass grid upgrade delays and smooth peaks—showing up as a pragmatic, near-term fix for constrained sites. (EV Charging Europe)

Standards are diverging by region (but converging within North America)

- In the US, the shift toward NACS continues: automakers are moving to native NACS inlets and leaning on adapters for legacy vehicles (a big deal for customer experience and utilization of existing networks). (Toyota USA Newsroom)

- Meanwhile, tracker data indicates both NACS and CCS connector counts grew strongly over 2025, with CCS still adding a large absolute number of connectors—so the transition is not “overnight.” (EV Charging Stations With Tom Moloughney)

Battery tech headlines: faster charging + safer chemistries + solid-state hype moving closer

- A flurry of headlines are clustering around solid-state / semi-solid readiness claims and higher energy density announcements; one example is Geely talking up a production-ready solid-state roadmap. Treat timelines cautiously, but it’s clearly back in the center of OEM messaging. (TechRadar)

- Separately, materials/process innovations aimed at meaningfully faster charging (without destroying cycle life) are getting attention—often framed as enabling higher C-rate charging. (Forbes)

Nordics: adoption leadership + fresh policy levers

Norway: effectively “post-ICE” for new car sales

- Norway hit ~96% BEV share in 2025 and ~97.6% in December 2025 (with year-end pull-forward dynamics tied to tax changes). (Reuters)

Sweden: new EV support starts March 18, 2026

- Sweden launches Elbilspremien with 1,300 SEK/month for up to 36 months (total 46,800 SEK) plus a potential 18,000 SEK start supplement for the lowest-income households. (naturvardsverket.se)

Why it matters: it’s structured to reduce monthly cost (useful for private leasing affordability), not just a one-off purchase bonus.

Europe: EV sales momentum + industrial policy tightening

Sales and regulation

- In Europe, EV sales surged in 2025 and EVs overtook petrol in December (monthly share), signaling mainstream momentum—despite brand reshuffling and continued subsidy/policy debates. (Financial Times)

“Made-in-Europe” rules and procurement push

- The European Union is preparing rules that would push EU-made content requirements for certain public purchases of green tech (including batteries/EV supply chain components). This can affect pricing, sourcing, and which battery packs qualify for public tenders. (Reuters)

Infrastructure: data and targets are getting more formalized

- The European Alternative Fuels Observatory continues publishing updated charging/vehicle datapoints and policy tracking—useful for benchmarking Nordics vs. EU averages. (alternative-fuels-observatory.ec.europa.eu)

Asia: scale + rapid iteration (and exports shaping everyone else’s market)

China: pivot from price war to “high-tech” positioning

- Coverage points to China’s market shifting emphasis toward higher-end tech (fast charging, battery swapping, and next-gen chemistries), with big players scaling infrastructure and pack tech to support it. (EV Infrastructure News)

Global market pressure via low-cost models

- Multiple regions are seeing adoption acceleration partly driven by cheaper models—often from Chinese OEMs—expanding the addressable market beyond early adopters. (The Guardian)

US: fast-charging expansion + NACS rollout moves from “promise” to “construction”

Network growth

- Reporting indicates US fast-charging expansion had its strongest year yet, with buildout led largely by private networks (important context for utilization and pricing). (Yahoo Autos)

OEM + network execution examples

- Toyota says NACS access expands DC fast-charging availability for its customers (adapters first, native inlets on newer models). (Toyota USA Newsroom)

- EVgo is actively deploying NACS ports, highlighting how quickly the ecosystem is retooling at the station level. (InsideEVs)

Practical “watch list” for the next 30–90 days

- Chargepoint reliability + pricing (especially HPC corridors): uptime and transparent pricing will increasingly decide brand loyalty.

- Grid-constrained sites: battery-buffered charging hubs will spread where connection queues are long. (EV Charging Europe)

- Battery safety and recalls: any OEM guidance limiting max charge state is a serious signal to watch (even if incidents are rare). (The Sun)

- Policy changes: Sweden’s Elbilspremien and EU procurement content rules may shift demand and supply patterns quickly. (naturvardsverket.se)

Hot EV headlines (as of 17 Jan 2026)

Nordics (Sweden, Norway, Denmark, Finland)

- Norway: EVs effectively “won” new-car sales in 2025 — Norway hit 95.9% BEV share of new registrations in 2025 (and ~98% in Dec), with a year-end rush ahead of VAT changes starting 1 Jan 2026. (Reuters)

- Sweden: targeted “Elbilspremien” starts applications 18 Mar 2026 — Naturvårdsverket confirms a new, income- and geography-targeted premium for BEVs; applications run 18 Mar 2026–30 Jun 2028. (Naturvårdsverket)

- Sweden: Volvo Cars pauses Novo Energy battery operations — Volvo halted activity at its Novo battery startup while it searches for a technology partner; remaining staff are laid off, underscoring pressure on European battery projects. (Reuters)

- Finland: “scrapping premium” returns for 2026–2027 — Finland is setting aside €20m for a scrappage-linked incentive scheme administered by Traficom. (Valtioneuvosto)

Europe (EU + UK)

- Germany: reported plan for new EV subsidy up to ~€6,000 — Reuters reports a German plan aimed at stimulating demand (portal expected later, with retroactive registrations from 1 Jan 2026 per the report). (Reuters)

- EU–China: tariffs vs “minimum price” undertakings — The European Commission issued conditions under which China-based EV makers may replace tariffs with minimum-price commitments, with investment in the EU also considered in evaluations. (Reuters)

- EU market context: BEVs ~16.9% share (Jan–Nov 2025) — ACEA’s latest published run-rate puts BEVs at 16.9% of EU registrations year-to-date through November 2025. (acea.auto)

- OEM performance snapshot: Porsche — Porsche said 22.2% of 2025 deliveries were fully electric (plus 12.1% PHEV), while China demand pressure remained a key headwind. (Reuters)

Asia (China + India highlights)

- China: EU trade channel stays central to 2026 export strategy — NIO publicly reiterated its intention to keep advancing in Europe as the EU’s “minimum price” pathway takes shape. (Reuters)

- China batteries: government flags “overcapacity” risk — Reuters reports China’s industry ministry urging battery manufacturers to optimize capacity and manage competition/supervision risks in EV + storage batteries. (Reuters)

- India: incentives increasingly tied to performance + charging buildout — Argus reports India revising EV incentives toward performance and allocating funding to fast-charging (especially for 2/3-wheelers). (argusmedia.com)

- India: PLI payouts support domestic EV ecosystem — Economic Times reports ~₹2,000 crore in incentives distributed to major players under the auto PLI scheme for FY25 performance. (The Economic Times)

United States

- Demand signal: global EV growth expected to slow in 2026 — Reuters cites Benchmark Mineral Intelligence: 2025 registrations up ~20% globally, but 2026 growth slowing amid policy/demand shifts; the same report notes a sharp North America drop around late-2025 policy changes. (Reuters)

- Charging funding: NEVI “Interim Final Guidance” is the operational baseline — FHWA’s updated NEVI guidance (effective Aug 2025) is what states and vendors are working from as projects resume/advance. (fhwa.dot.gov)

- On-the-ground charger buildout tracking — The US DOE’s Alternative Fuels Data Center publishes quarterly infrastructure trend reporting based on the Station Locator dataset. (afdc.energy.gov)

Battery & charging news (cross-regional “what matters”)

- Europe’s battery industrial policy stress-test is ongoing — Volvo pausing Novo is a concrete example of how partner availability, financing terms, and cost inflation can stall EU-based cell ambitions. (Reuters)

- China is managing both dominance and risk — Beijing is simultaneously benefiting from scale in batteries (EV + storage) and warning about overcapacity/competition as the sector matures. (Reuters)

- US charging: the rules and money flows matter as much as hardware — NEVI guidance and state-level execution remain the key swing factors for corridor reliability and uptime expectations. (fhwa.dot.gov)

- Europe HPC trend: megawatt-class hardware is moving from pilot to rollout — IONITY’s MCS procurement (Alpitronic HYC1000) is one of the clearer signals of 600kW–1MW-capable deployments scaling on major corridors. (Ionity)

What to watch next (practical “next milestones”)

- Sweden: Elbilspremien application opening 18 Mar 2026 and eligibility details/implementation updates. (Naturvårdsverket)

- Germany: confirmation of subsidy design + portal timing (Reuters notes May for applications). (Reuters)

- EU–China: which brands/models submit acceptable minimum-price undertakings, and what that does to EU retail pricing. (Reuters)

- US charging: how quickly states convert NEVI guidance into awards + operational stations (watch uptime/maintenance requirements). (fhwa.dot.gov)

Januari 3 – 2026

1) The global scoreboard

- BYD passed Tesla in 2025 battery-electric sales: BYD reported about 2.26M BEVs vs Tesla about 1.63M (Tesla down ~9% YoY). (The Guardian)

- BYD also reported ~4.6M total vehicles in 2025 (incl. PHEVs), highlighting how fast its scale is growing. (Bloomberg)

2) Nordics & Europe: the clearest signals right now

- Norway is basically “all-EV” now: 95.9% of new cars in 2025 were fully electric (almost 98% in Dec). Tesla led brand share, VW and Volvo followed; Chinese brands (incl. BYD) increased share. (Reuters)

- Tesla’s Europe is split: In Dec 2025, Tesla registrations surged in Norway but fell sharply in France (-66% YoY Dec) and Sweden (-71% YoY Dec); Reuters also notes Tesla’s Europe market share fell in 2025 vs 2024. (Reuters)

3) Charging: fewer apps, more rules, more reliability

- EU AFIR is now the big “forcing function”: from 2025, member states must enable ≥150 kW fast charging every 60 km along core TEN-T corridors (cars/vans). (Consilium)

- Spark Alliance (IONITY + Fastned + Electra + Atlante): aims to make ~1,700 stations / ~11,000 charge points accessible and payable across networks using your “home” charging app—less roaming pain. (IONITY)

- UK warning sign: major UK outlets reported a slowdown in charger rollout in 2025, raising concerns about meeting future demand. (The Guardian)

4) Policy & incentives: reshaping demand in 2025–2026

- US: Reuters reported federal EV tax credits expired Sept 30, 2025 (new $7,500 / used $4,000), and executives warned of a post-credit demand hit. (Reuters)

- EU: the Commission brought forward a review of the 2035 zero-tailpipe-CO₂ target (earlier review timing) amid automaker pressure—and later outlined proposals that would change how the 2035 endpoint works. (Reuters)

5) Batteries & tech: what to watch beyond “LFP vs NMC”

- Sodium-ion is getting louder: CATL messaging points toward wider sodium-ion adoption in 2026 across multiple segments; Reuters background also highlights CATL’s view of sodium-ion as strategically important. (CnEVPost)

- US battery supply shift: a Reuters Breakingviews piece argues the US is moving toward battery “autonomy” by 2026, with Korean makers (LGES/Samsung SDI/SK On) heavily invested and energy-storage demand helping absorb capacity. (Reuters)

6) Biggest brands: what’s “hot” for each

- Tesla: losing share in parts of Europe (notably Sweden/France), while still dominating in Norway; competition + lineup age are recurring themes. (Reuters)

- BYD: scale story + overseas expansion narrative continues; 2025 BEV crown is the headline. (The Guardian)

- Kia/Hyundai: Kia EV2 (Europe-focused B-segment EV SUV) has a world premiere scheduled Jan 9, 2026 at the Brussels Motor Show. (Kia Global Media Center)

- BMW: pushing Neue Klasse hard—BMW says the next iX3 brings up to 400 kW charging, ~10–80% in ~21 min, and is heading to CES 2026. (BMW Group PressClub)

- Volvo/Polestar: Polestar secured a term loan facility up to $600M from Geely to support liquidity. (Reuters)

December 30th – 2025

Global awards

- World Car Awards 2025 winners:

- World Car of the Year: Kia EV3

- World Electric Vehicle: Hyundai Inster / Casper Electric

- World Luxury Car: Volvo EX90

- World Performance Car: Porsche 911 Carrera GTS

- World Urban Car: BYD Seagull / Dolphin Mini

- World Car Design: Volkswagen ID. Buzz (worldcarawards.com)

Nordics (national “Car of the Year” awards)

- Norway – Car of the Year 2025:smart #5 (media.smart.com)

- Denmark – Car of the Year 2025: Renault 5 E-Tech + Nissan Micra (joint winners / closely related models; some headlines shorten this to “Renault 5”) (blog.bilbasen.dk)

- Finland – Car of the Year (Vuoden Auto Suomessa) 2026: Mercedes-Benz CLA (215 points) (auli.yhdistysavain.fi)

Europe

- European Car of the Year 2025: Renault 5 / Alpine A290 (caroftheyear.org)

UK (England)

- What Car? Car of the Year Awards 2025 (overall): Renault 5 52kWh Techno (What Car?)

- UK Car of the Year Awards 2025 (overall): Kia EV3 (kiapressoffice.com)

- Auto Express Car of the Year 2025 (overall): Škoda Elroq (Auto Express)

USA

- NACTOY 2025: Honda Civic Hybrid (Car), Ford Ranger (Truck), Volkswagen ID. Buzz (Utility) (Årets Bil, Lastbil och Elverktyg)

- MotorTrend Car of the Year 2025: Mercedes-Benz E-Class (MotorTrend)

Asia (major national awards)

- Japan Car of the Year 2025–2026: Subaru Forester (Forbes)

- Korea Car of the Year 2025: Kia EV3 (koreabizwire.com)

- India (ICOTY) 2025: Mahindra Thar Roxx (ICOTY (Indian Car Of The Year))

Nordics (EV-only): Elbilsveckan (SE-POD)

This is the Swedish year-end EV awards discussed in Elbilsveckan – Episode 161 (Dec 29, 2025) with Peter Esse (Elbilsveckan), Alrik Söderlind (Alriks Bilar), and Kristofer Rask (Allt om Elbil) (Elbilsveckan is run by Peter Esse & Christoffer Gullin, and Gullin is tied to Elbilsmagasinet). (Elbilsveckan)

Categories in the episode:

- Small EV of the Year

- Guilty Pleasure of the Year

- Best Used EV of the Year

- Surprise of the Year

- Disappointment of the Year

- EV of the Year (overall) (Elbilsveckan)

Winners :

- Small EV of the Year: Renault 5

- EV of the Year (overall): Mercedes-Benz CLA

- Other categories: left for listeners to hear in the episode (Elbilsveckan)

December 23d – 2025

Nordics (Sweden, Norway, Denmark, Finland)

- Norway is basically “all-EV” now: BEVs hit 97.6% of new registrations in November 2025, and Tesla also set a new annual single-brand sales record in Norway (driven by Model Y). (electrive.com)

- Sweden: grid build-out to enable more electrification: Svenska kraftnät launched four new transmission-line projects in the north (Norrbotten/Västerbotten) to strengthen the grid for new electricity production and major electrified industry loads—important for charging growth too. (svk.se)

- Volvo EX60 — what’s new right now

- Reveal date confirmed: Volvo will still reveal the EX60 on 21 January 2026 in a livestream from Stockholm. Volvo Cars+1

- Production timing + location: Production is set to start in the first half of 2026 at Volvo’s Torslanda (Gothenburg) plant. Volvo Cars+2Cision News+2

- Positioning: Volvo says it will have “faster charging” and “longer range than any Volvo car to date” (exact battery/kW figures not published yet). Volvo Cars+1

- Key tech debut: Volvo’s world-first “multi-adaptive safety belt” is slated to debut in the EX60 (uses sensor data + more load-limiter “profiles,” and supports OTA improvements). Volvo Cars+2The Verge+2

- Design/detail chatter: A design piece reported Volvo’s new typeface “Volvo Centum” is intended to debut with the XC60 refresh and EX60 (nice little UI/brand hint, but still not a spec sheet). Wallpaper*

- Sweden + Finland: TEN-T charging expansion backed by EU funds: 72 new recharging sites / 342 charge points (≥150 kW) along the TEN-T corridor, co-funded by €8m+. (CINEA)

- Denmark: fast-charger growth leadership (Europe): Denmark recorded the highest growth in public DC fast chargers in Europe in Q1 2025 (+104% YoY) (ICCT). (theicct.org)

- Sweden: new accessibility focus for chargepoints: a national standard for more accessible charging-station design is being highlighted by industry participants. (BraunAbility Europe)

Europe (EU + EFTA) — batteries, factories, policy pressure

- EU battery makers push “local content” rules: industry leaders argue Europe needs stronger local sourcing requirements to compete with Asia and reduce dependence on China. (Financial Times)

- Spain: big LFP manufacturing bet: Stellantis + CATL broke ground on a €4.1bn LFP gigafactory in Zaragoza, targeting operations by end-2026. (Automotive Logistics)

- Italy: battery project uncertainty: Stellantis-backed ACC is reported to be close to scrapping the Termoli gigafactory plan (decision expected late 2025/early 2026). (Reuters)

- EV sales momentum in Europe (Nov 2025): registrations rose for a fifth month; BEVs were about 21% of EU market share (and ~98% in Norway). (Reuters)

UK / England — charging rollout vs EV targets

- Public charger rollout slowed in 2025: reporting shows the UK added ~13,500 chargers in 2025 (slowest pace since 2022), with grid connection delays and policy/investment uncertainty among cited factors. (The Guardian)

- ZEV mandate review pulled forward: the UK government is starting its review of ZEV sales targets earlier than planned (pressure from automakers), while the 2035 phase-out remains stated policy. (electrive.com)

- Manufacturing transition: Nissan’s Sunderland plant is being positioned as “future-proofed” for EV production, even as broader transition targets get debated. (The Guardian)

Asia — fast-charging leaps + the battery supply machine

- China’s battery boom (storage + EV): Reuters highlights a surge tied to power-market reforms and global storage demand; China remains dominant in cell supply and exports. (Reuters)

- BYD’s ultra-fast charging narrative keeps growing: BYD’s megawatt-class / “flash charging” messaging (e.g., ~400 km in ~5 minutes on its platform) continues to drive headlines and competitive pressure on charging tech roadmaps. (BYD)

- Sodium-ion moving toward scale: CATL says its Naxtra represents mass-production progress for sodium-ion, aiming to reduce lithium dependence. (catl.com)

- Solid-state reality check (Japan): Toyota + Sumitomo reported progress on durable cathode materials, targeting material mass production around FY2028 and aiming for EV rollout ~2027–2028. (Reuters)

United States — NACS access + battery JV reshuffles

- More brands getting Tesla Supercharger access (NACS): Volkswagen owners in the US began getting Supercharger access (via adapter + some software updates), and Tesla continues opening its network through 2025 as automakers transition to NACS. (Car and Driver)

- Battery manufacturing chess move: LG Energy Solution is selling $2.86B of factory building/assets in Ohio to Honda’s US unit (restructuring the JV asset setup; not framed as exiting the JV). (Reuters)

One big cross-regional theme to watch

- Battery chemistries + commodities are reshuffling: Reuters notes global EV sales rising while battery metals (lithium/nickel/cobalt) stay under pressure from oversupply and the ongoing shift toward cheaper LFP and emerging alternatives like sodium-ion. (Reuters)

Here’s what’s newest + biggest in self-driving (robotaxis + “eyes-off” highway systems) in Europe and the US (as of Dec 27, 2025).

Europe - UK accelerates toward robotaxi pilots (2026): Uber and Lyft announced partnerships with Baidu (Apollo Go) to run UK robotaxi trials in 2026 (London focus), helped by the UK’s Automated Vehicles Act 2024 clarifying liability. (Reuters)

- UK government just opened a major “call for evidence” (Dec 4, 2025): This is a concrete step toward the secondary rules needed to authorize and regulate self-driving vehicles, with a passenger piloting scheme launching next spring and the stated goal of having the full framework in place from 2H 2027. (GOV.UK)

- Germany / EU: real public pilots are running (shuttles): The EU Urban Mobility Observatory highlights Germany’s KIRA project operating autonomous public-transport shuttles with passengers (Langen/Egelsbach, with expansion planned). (EU Urban Mobility Observatory)

- Level 3 “eyes-off” in Europe is still mostly Germany-led: Mercedes’ Drive Pilot has approval/rollout steps that allow use up to 95 km/h on German Autobahn (under specific conditions). This is still geographically and conditionally constrained—important, but not “general autonomy.” (Mercedes-Benz Group)

- United States

- Waymo had a high-profile “robotaxi stress test” failure mode (Dec 20 SF blackout): A major power outage knocked out traffic lights; Waymo vehicles stalled at intersections, and the event is now driving renewed scrutiny of remote assistance/teleoperation and emergency protocols by California regulators. (Reuters)

- Waymo recall + NHTSA pressure (school buses in Texas): Reuters reports a software recall affecting 3,000+ vehicles tied to behavior around stopped school buses, following a federal probe. (Reuters)

- Zoox recall (Dec 23): Amazon’s Zoox is recalling 332 vehicles after an ADS software issue that could cause vehicles to cross the center line or stop in oncoming paths near intersections (software update issued). (Reuters)

- Tesla under heavier “self-driving claims” scrutiny in California: Reuters reports a California regulator deferred a potential sales-suspension order, giving Tesla more time to address allegations of misleading marketing about self-driving capability. (Reuters)

- NHTSA’s big Tesla FSD probe continues: The U.S. regulator opened an investigation into ~2.88M Teslas over reports of traffic-law violations while using FSD (supervised). (Reuters)

- What this means (quickly)

- Europe’s near-term story: regulation + structured pilots (UK + German shuttle programs), with limited but real Level 3 availability in specific markets. (GOV.UK)

- US near-term story: scaling robotaxis is forcing “edge-case” accountability (blackouts, school buses, intersections) + more recalls and investigations as fleets grow. (Reuters)

Middle of December 2025

Big global themes right now

- Batteries are shifting “down-market”: more LFP + the first real sodium-ion ramp talk (cheaper, safer, less lithium dependence). CATL says its new sodium-ion brand Naxtra enters mass production in Dec 2025, while its Gen-2 Shenxing fast-charge pitch is “5 minutes for ~520 km” (claimed, version-dependent). (Reuters)

- Fast charging arms race: networks are building toward next-gen 800V / 600 kW capability in Europe (IONITY expansion plan includes up to 600 kW tech and big growth targets). (ionity.eu)

- Self-driving splits into two worlds:

- L2 “supervised” driver assist (you’re always responsible) is getting regulatory heat (Tesla naming/marketing scrutiny in California, plus proposed US legislation to constrain where Level 2+ systems can operate). (Reuters)

- L3 “conditional autonomy” is becoming more real in China with formal approvals. (Reuters)

Nordics

- Norway is basically the global EV endgame: November hit ~97.6% share of new registrations being fully electric (BEV). (electrive.com)

- Volvo pipeline: Volvo has said the EX60 will be revealed Jan 21, 2026 in Stockholm and built in Gothenburg (Torslanda), with production planned in H1 2026. (Cision News)

- Volvo EX90 tech step: Volvo has announced an upgraded EX90 with an 800-volt system and that 2025 EX90 owners get a one-time free core computer upgrade via workshop visit. (Volvo Cars)

- Northvolt fallout continues to reshape EU battery plans: Northvolt filed for bankruptcy in Sweden 12 March 2025. (northvolt.com) The EU is mobilising €8.5m (EGF) to support ~5,800 dismissed workers. (Employment, Social Affairs and Inclusion)

- Heavy transport electrification is accelerating in Scandinavia: Scania is pushing Megawatt Charging System (MCS)—talking up to 2× CCS2 and aiming for 80% <30 min (target) in its comms. (Scania Corporate website)

Europe

- Policy whiplash is the story: major reporting says the EU is considering softening the “100% zero-CO₂ by 2035” approach (e.g., a 90% reduction framework), which could keep some hybrids/range-extenders in play—still needs approvals. (Reuters)

- Market reality: EU BEV share was about 16.4% up to Oct 2025 YTD, while hybrids are the biggest slice. (acea.auto)

- Chinese brands keep expanding into Europe: Changan announced entry into Italy and Spain with EV SUVs and plans for broader rollout + dealer growth. (Reuters)

- Charging build-out is scaling: IONITY’s plan includes more sites and higher power hardware aimed at next-gen vehicles. (ionity.eu)

Asia

- China is the battery gravity well: SNE Research reports 933.5 GWh global EV battery usage (Jan–Oct 2025), +35.2% YoY—with CATL/BYD dominating share. (sneresearch.com)

- Sodium-ion goes from “lab idea” to “production story”: CATL’s Naxtra sodium-ion is positioned as LFP-class energy density and mass production from Dec 2025 (per Reuters). (Reuters)

- L3 autonomy is moving fastest in China: China approved its first batch of L3 vehicles (Changan + BAIC/Arcfox models). (Reuters)

- L3-ready product race: Reuters has previously reported Zeekr and Xpeng planning L3-capable/ready offerings. (Reuters)

United States

- EV market is choppy vs the rest of the world: one summary view says global EV sales grew in 2025, while North America lagged/declined amid incentive/policy shifts (interpret cautiously—different trackers vary). (Business Insider)

- NACS/Supercharger access is still a strategic moat: Tesla says its North American Supercharging network is opening to more automakers through 2025 as the industry transitions to NACS. (Tesla)

- Robotaxis: Waymo is the momentum leader: Financial Times reports Waymo exploring a large fundraise and expanding into more cities and internationally (including London/Tokyo pilots mentioned). (Financial Times)

- Tesla “self-driving” regulation pressure: Reuters reports California is pressing Tesla on Autopilot/FSD marketing terms (sales suspension order delayed while Tesla responds). (Reuters)

- US battery strategy: cheaper chemistries + new cathodes: GM/LG’s Ultium Cells plans LFP production lines in Tennessee (commercial production expected later), and they’ve also talked up an LMR prismatic cell concept for higher energy density at LFP-like cost. (news.gm.com)

Quick “watch list” for early 2026

- Volvo EX60 reveal (Jan 21, 2026) and what SPA3 + software stack really means in production cars. (Cision News)

- China L3 rollouts (what’s truly L3 vs geo-fenced demos). (Reuters)

- Sodium-ion reality check (which models actually ship with it at scale). (Reuters)

- 600 kW charging deployments and whether cars arrive that can exploit it broadly. (ionity.eu)

- Financial Times

- Reuters

- Reuters

- Reuters

- Reuters

- wsj.com

- The Guardian

- Business Insider

- Reuters

—————————————————————————————————————————–

Do you want EV news in your mailbox every week – SUBSCRIBE

—————————————————————————————————————————–

Globally, EVs are still growing fast, but the “hot” stuff now is value, compact crossovers and Chinese brands rather than just premium Teslas.

December 7th 2025

Chart – BEV brands Europe (H1 2025):

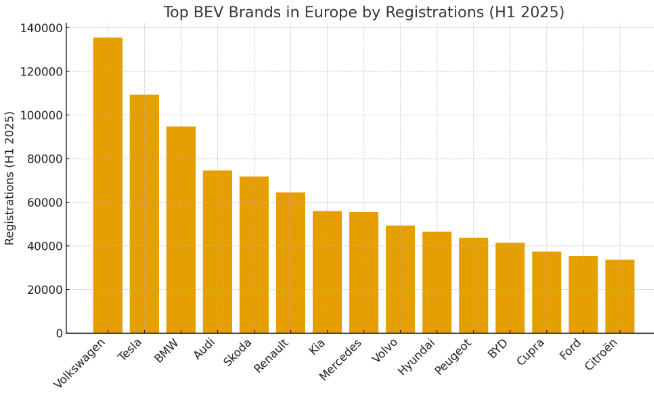

Based on JATO data for the first half of 2025, Volkswagen is now the largest BEV brand in Europe (~135k registrations), followed by Tesla (~109k), then BMW, Audi, Skoda, Renault, Kia, Mercedes, Volvo, Hyundai, Peugeot, BYD, Cupra, Ford and Citroën. best-selling-cars.com

Nordics

Market vibe:

Nordics are still EV-kingdom, but the mix is shifting away from just Tesla and towards Volvo, VW, Škoda and Chinese brands. Norway remains hyper-EV, while Sweden/Denmark/Finland grow more “normal” but steady. (electrive.com)

Hot themes:

- Big volumes, different tastes per country

- Norway: Tesla Model Y still a monster, topping July EV rankings. (electrive.com)

- Sweden: overall best-selling cars now Volvo XC60/XC40 and VW ID.7; Model Y has dropped down the list. (Focus2Move)

- New “Nordic-friendly” models

- VW ID.7 doing surprisingly well in Sweden (big cabin, comfy cruiser). (Focus2Move)

- Škoda Elroq and VW ID.4/ID.3 are among Europe’s top EVs overall and fit Nordic preferences (space + tow capability). (Eleport)

- Volvo EX30/EX40: extremely strong in Denmark/Sweden as “local” compact crossovers (sources roll into the Nordic growth stats). (theicct.org)

- Chinese brands quietly getting big

- BYD, Xpeng, Zeekr are growing fast in Europe and the Nordics are usually early adopters (BYD among Europe’s fastest-growing EV brands). (Autovista24)

If you’re thinking “what’s hot to buy/lease” in the Nordics right now:

Think ID.7, ID.4, EX30/EX40, Elroq, Model Y (still huge in Norway) plus BYD/Xpeng/Zeekr if you want to ride the Chinese wave.

Europe (outside the Nordics)

Market vibe:

Europe was a bit wobbly in 2024 but is back to strong EV growth in 2025:

- >2 million EVs Jan–Oct 2025, up 26% YoY. (electrive.com)

- EVs around 16–17% market share, even overtaking ICE in some months. (arenaev.com)

What’s hot right now

1. Top-selling models

From Jan–Oct 2025, the top EVs in Europe are: (Eleport)

- Tesla Model Y – still the benchmark crossover

- Škoda Elroq – surprise hit, very strong start

- Renault 5 / Alpine A290 – “future-retro” small EV, big buzz

- VW ID.4

- VW ID.3

So the “it-zone” is clearly C-segment crossovers & hatchbacks with decent price, not luxury stuff.

2. Tesla is hot and under pressure

- Model Y & 3 still #1 and #2 globally in BEV sales. (Autovista24)

- But in Europe, Tesla’s market share and image have taken a hit; registrations are down ~30% and political backlash against Musk is real in some countries. (WIRED)

- Tesla just launched a cheaper Model 3 Standard in Europe (from ~€38k in Germany) to fight demand softness and Chinese competition. (The Guardian)

3. Chinese “value EVs”

- Brands like BYD, MG, Xpeng, Zeekr are growing insanely fast; BYD’s European EV sales are up 300%+ YoY and it’s among the fastest-growing EV brands. (Autovista24)

- MG4 and BYD Dolphin undercut European C-segment EVs by ~12–13% on price, which is exactly where demand is hot. (assets.kpmg.com)

- New arrivals Zeekr (launched in Germany with three models) and Changan’s Avatr/Nevo will expand aggressively over the next 1–2 years, often with local EU factories to dodge tariffs. (Reuters)

4. PHEV comeback

Because of tariffs and cost pressure, many Chinese brands are now pushing plug-in hybrids hard in Europe, with PHEV registrations up almost 60% YoY and BYD already a top PHEV brand here. (best-selling-cars.com)

Asia (mainly China + neighbours)

Market vibe:

Asia = China first, then everyone else. China is now the EV superpower.

1. China is on another planet

- June 2025: EVs (BEV+PHEV) were 53% of all car sales in China. (CleanTechnica)

- BYD is the world’s largest EV maker with almost 20% global EV market share in 2025 YTD. (visualcapitalist.com)

- Best-selling BEVs in China H1 2025 include:

- Geely Geome Xingyuan (#1 BEV)

- BYD Seagull (#2, ~5% share)

- Tesla Model Y (top 3). (Autovista24)

So what’s “hot” there?

- Super-cheap small EVs like the BYD Seagull

- Compact sedans/crossovers like Qin Plus, Geely Xingyuan, BYD Song. (CleanTechnica)

2. Chinese export machine

- Between Jan–May 2025, BYD exported >210,000 EVs, with Asia 36% and Europe 27% of those exports; top export models include Song Plus, Seal, Dolphin, Atto 3. (DDong Automobile)

- Chinese brands are adding new EV models at insane speed (BYD alone got approval for 38 models recently). (Rest of World)

- Policy has shifted from raw subsidies to strategic pressure: dual-credit policy + targeted incentives for trading ICE in for an EV. (BCG Global)

3. Rest of Asia

- Korea: Hyundai Ioniq 5/6 and Kia EV6/EV9 dominate, with exports to Europe/US.

- Japan & much of SE Asia: still more hybrid/ICE-heavy, but Chinese EVs (especially BYD) are surging; SE Asia is a big target for Chinese exporters (and also a dumping ground for ICE cars that China can’t sell at home). (Financial Times)

In short: in Asia, “hot” = cheap Chinese EVs and BYD/Geely dominance, plus a parallel high-tech track from Hyundai/Kia.

USA

Market vibe:

Despite media noise, US EV demand is at record levels:

- >1.2 million EVs sold in the first three quarters of 2025, the highest ever.

- EV share just under 12% of new light-duty vehicles in Q3 2025. (theicct.org)

At the same time, some US automakers are nervously slowing EV investment and leaning back toward hybrids, even though the market is still growing.

What’s hot in the US

1. Core volume models

Top-selling EVs (Q2 2025) are: (CleanTechnica)

- Tesla Model Y – still the US EV king

- Tesla Model 3

- Chevy Equinox EV (big new player in the “affordable crossover” space)

- Hyundai IONIQ 5

- Ford Mustang Mach-E

More than 100 EV models are now on sale in the US; Tesla’s share has dropped from ~60% in 2020 to ~38% in 2024 because of this competition. (IEA)

2. Trucks & lifestyle EVs

- Ford F-150 Lightning, Rivian R1T/R1S, and Chevy Silverado EV are important but still niche vs crossovers.

- Tax credits (IRA) + state ZEV mandates keep the market moving, even while some brands publicly talk about “slowing EV plans.”

So in the US, “hot” really means mid-priced crossovers with federal tax credit eligibility, plus lifestyle pickups for early adopters.

Super-short summary for you

- Nordics: Still EV heaven. Hot = Volvo (EX30/EX40), VW ID.7/ID.4, Škoda Elroq, Model Y in Norway, plus rising BYD/Xpeng/Zeekr.

- Europe: Strong 2025 rebound. Hot = compact crossovers and hatchbacks (Model Y, Elroq, Renault 5, ID.4/ID.3) and aggressively priced Chinese EVs + PHEVs.

- Asia: China rules. Hot = BYD & Geely small/cheap EVs, 50%+ EV share at home, and massive export push (Seal, Dolphin, MG4, Atto 3, etc.).

- USA: Record sales, ~12% share. Hot = Model Y/3, Chevy Equinox EV, Ioniq 5, Mustang Mach-E, plus tax-credit-friendly crossovers and some pickup EVs.

If you want, next step I can:

- Build a matrix of “hot models by region” (WLTP/range, charge rate, 0–100, price band),

- Or zoom in just on “what’s hot for Sweden right now” for your leasing/website use.

Here’s a fast region-by-region snapshot (Nordics → Europe → Asia → USA), focused on what’s actually hot right now (late 2025).

Here’s a quick “world tour” of the hottest BEV/PHEV news right now (late Nov 2025), split by region.

Nordic countries

1. Nordics still the global EV benchmark (and getting more BEV-heavy)

- In Norway, over 96% of new car sales H1 2025 were plug-ins: ~93.7% BEVs and 2.4% PHEVs.(Nordea)

- From April 2025 Norway raised taxes on ICE cars and PHEVs, specifically to push the BEV share even higher toward the goal of 100% zero-emission sales by end of 2025.(IEA)

- Across Europe, the Nordics (Norway, Sweden, Denmark, Finland, plus Iceland) clearly lead: in 2024 electric powertrains were already >50% of new car registrations in these countries.(eea.europa.eu)

2. PHEVs are fading in some Nordics

- In Denmark, EVs were 66% of new car registrations Jan–May 2025, with 63% BEV and just 3% PHEV. BEV registrations jumped 55% vs 2024, while PHEVs fell 34% – a clear policy-driven shift toward full BEVs.(theicct.org)

3. “EV-ready” index puts Nordics at the very top

- A 2025 EV Readiness report ranks Norway, Denmark, Sweden and Finland, plus the Netherlands, as the most EV-ready markets in the world – based on high BEV shares, dense public charging, and strong policy frameworks.(EVBoosters)

Nordics:

- BEVs absolutely dominate new sales.

- Policy is now actively penalising PHEVs and ICE rather than just rewarding BEVs.

Rest of Europe

1. EU 2035 ban on new ICE cars is being re-opened

- EU leaders are now considering softening the 2035 ban on new petrol/diesel car sales, driven by slower EV uptake, economic worries and industry pressure. Proposals include allowing certain low-emission hybrids and synthetic-fuel ICEs beyond 2035.(The Verge)

- EV-focused groups warn this could undercut climate goals and make it easier for Chinese brands to gain share if Europe dithers on full electrification.(The Verge)

2. Chinese brands are winning Europe’s new “PHEV war”

- Chinese OEMs (BYD, Chery/Jaecoo, etc.) are gaining fast in the European PHEV segment with cheaper, longer-range plug-in hybrids, while many European legacies use PHEVs to keep combustion alive a bit longer.(Financial Times)

- PHEV sales in Europe surged ~32% in the first 9 months of 2025 to almost 920,000 units, even though the overall PHEV market share slipped from 9% to 7% between 2021 and 2024 as BEVs grew.(Financial Times)

3. North–South divide getting sharper

- PwC’s 2025 EV readiness index shows North-west Europe (Nordics + NL) racing ahead, while Southern and Eastern Europe lag on both charging infrastructure and BEV/PHEV shares.(EVBoosters)

- Many EU countries are tweaking incentives and road taxes – e.g. in the Netherlands, BEVs and PHEVs pay reduced motor-vehicle tax in 2025, but rates ramp up towards 2030, shifting from pure subsidy regime to “normalised” taxation.(alternative-fuels-observatory.ec.europa.eu)

TL;DR Europe:

- Policy debate: stick to pure BEV 2035 target vs. keep hybrids alive.

- Chinese brands are strong in PHEVs, especially as some EU makers are late with compelling BEVs in certain segments.

Asia

China

1. BEVs retake the lead from PHEVs in growth

- China just hit a new record: ~8.33 million BEV shipments and 4.61 million PHEVs this year so far, with BEVs now the main driver of electrification.(Automobility)

- Recent data shows a “two-speed” market: BEV sales up about 20% year-on-year, PHEV sales down ~10% YoY, and BEVs now 36% of the total Chinese car market in October.(CleanTechnica)

- Earlier (2021–24), PHEV share in China rose from 3% to 19% of new car sales, but 2025 is the first year where BEV share starts growing again relative to PHEVs, helped by better charging and narrowing BEV price premiums.(theicct.org)

TL;DR China: big PHEV wave 2021–24, but BEVs are clearly back on top this year.

India

2. India is going hard on infrastructure and local batteries

- The government has offered extra incentives to states to accelerate a nationwide public charging network, specifically to boost EV adoption.(allindiaev.com)

- Policy moves include removing import duties on key EV battery components and a wider incentive scheme worth about 109 billion rupees (~$1.3 bn) to support EV adoption.(mobec.io)

TL;DR India: EV share is still modest versus China/Europe, but policy is strongly pro-EV, focused on batteries + charging rather than just car purchase subsidies.

Japan & South Korea

3. Japan Mobility Show: hybrids still king

- At the 2025 Japan Mobility Show, the number of BEV models has jumped from ~15 (2019) to nearly 80, but only around 16 are from Japanese brands – the rest are foreign. Japanese OEMs still emphasise hybrids and plug-in hybrids over pure BEVs.(just-auto.com)

4. South Korea: high BEV sales + more subsidies coming

- South Korea’s domestic BEV sales hit an all-time high in September 2025, though conventional hybrids still outsell BEVs in volume.(argusmedia.com)

- To keep momentum and offset US tariffs, the government plans to boost EV subsidies by ~20% in 2026, taking the pot to 936 bn won (~$660 m) and adding more financing support for the auto supply chain.(Reuters)

Asia:

- China: BEVs accelerating again; PHEVs still big but losing share.

- India: policy push for charging + local battery production.

- Japan: still “hybrids first”.

- Korea: strong BEV growth plus fresh subsidy money.

United States

1. Federal EV tax credits just expired – big potential shock

- As of 30 Sept 2025, the main US federal tax credits for new, used and leased EVs (sections 30D, 25E, 45W under IRA) have expired early, cut off by a July 4 budget deal – they were originally supposed to run to 2032.(Plug In America)

- A separate budget reconciliation bill also aims to scrap remaining EV uptake incentives and add new EV-specific taxes to raise highway funds.(EV Infrastructure News)

- Industry studies suggest EV registrations could drop by ~27% without those tax credits, and automakers already warn about a potential “EV sales cliff”.(Reuters)

2. Hybrids (including PHEVs) are booming, led by Toyota

- Toyota is investing $14 bn in a battery plant in North Carolina to ramp up batteries mainly for hybrids and PHEVs (and some BEVs), part of a larger $24 bn+ US investment plan.(Wall Street Journal)

- Around half of Toyota’s US sales are now hybrids/EVs; the Camry and Sienna are hybrid-only and the RAV4 goes fully hybrid next year. Toyota is openly betting that hybrids and PHEVs will suit US consumers better than pure BEVs in the near term.(Wall Street Journal)

TL;DR US:

- Policy shock: federal EV purchase credits are gone, which may slow BEV uptake.

- Market is pivoting hard towards hybrids/PHEVs, even as some BEV-only players push on.

Global signals for BEVs vs PHEVs

1. Growth still strong, but slower and more uneven

- About 17.3 million electric cars were built in 2024, up ~25% vs 2023, with China accounting for >70% of global production.(IEA)

- In H1 2025, BEVs were about 65% of global plug-in sales, with PHEV vs BEV mix shifting by region (PHEVs up in China earlier, down in Europe; US shares small but growing).(theicct.org)

2. Charging infrastructure is both a success and a bottleneck

- Public charging points have more than doubled since 2022 to >5 million worldwide, but growth is starting to lag behind earlier EV forecasts.(IEA)

- A recent S&P analysis cut the 2030 forecast for BEV stock by ~18% and PHEV stock by ~6.5% versus last year’s expectations, citing slower infrastructure rollout and policy uncertainty.(S&P Global)

If you want, next step we can zoom in on specific models or brands (e.g. BYD vs VW in Europe, Kia/Hyundai vs Tesla in the Nordics, Toyota’s US PHEVs, etc.) or focus only on one region for a deeper dive.

Here’s a region-by-region snapshot of the most interesting EV news for November 2025

We’ve focused on things that matter for market share, pricing, and future models.

- Wall Street Journal

- New York Post

- EVBoosters

- Reuters

- The Guardian

- Reuters

- eea.europa.eu

- EVBoosters

- EVwire

- Reuters

🇳🇴🇸🇪🇩🇰🇫🇮 Nordics / Northern Europe

- Nordics crowned “most EV-ready” in Europe (PwC / EV Readiness Index 2025)

- New eReadiness 2025 report ranks Norway, Denmark, Sweden, Finland + the Netherlands as the most EV-ready countries in the world, combining:

- Very high EV sales share

- Dense public-charging coverage

- Strong, stable policy frameworks (EVBoosters)

- Implication for you (Sweden): Nordics are still benchmark region for infrastructure build-out and policy – good context when you benchmark prices, charging, and TCO vs rest of EU.

- New eReadiness 2025 report ranks Norway, Denmark, Sweden, Finland + the Netherlands as the most EV-ready countries in the world, combining:

- Nordic spotlight from ICCT (a bit earlier but heavily cited in November)

- ICCT “Market Spotlight” on Denmark, Sweden, Finland highlights them as Europe’s EV market leaders, with very high BEV share of new registrations and fast charging-network expansion. (Internationella rådet för ren transport)

🇪🇺 Europe (including broader EU + UK)

- Global EV sales up, Europe still strong – October data

- Research firm Rho Motion: global EV (BEV+PHEV) sales +23% in October 2025 y/y.

- Europe led regional growth, with strong demand in Germany, France, UK; EU also approved more battery projects. (Reuters)

- New data: BEVs now ~13.6% of all new EU cars; PHEVs 7.3%

- European Environment Agency indicator updated in November 2025 shows:

- 2024 registrations in EU: 13.6% BEV, 7.3% PHEV of all new cars.

- Number of new electric cars went from ~600 in 2010 to 2.4 million in 2023. (eea.europa.eu)

- European Environment Agency indicator updated in November 2025 shows:

- ACEA says 2030–2035 CO₂ targets for cars/vans “not achievable” on current path

- European carmakers’ association ACEA warns current policies/market conditions mean 2030–2035 CO₂ targets for cars & vans are at risk.

- Notes that BEVs were 16.1% of new registrations in September 2025 YTD; wants a “smarter regulatory path” and specific approach for vans. (ACEA)

- This matters for you: could impact future incentives, taxes, and company car rules that drive EV leasing offers in EU/Nordics.

- Renault revives Twingo as cheap city EV (sub-€20k)

- Renault unveiled a new electric Twingo (city car) to boost EV sales.

- Launch: early 2026, price under €20,000, using LFP battery from CATL; built in Slovenia.

- Dacia version expected < €18,000. (Reuters)

- This fits your interest in affordable EVs and small-car leasing/TCO in EU cities.

- China’s brands push harder into Europe using UK as gateway

- Guardian piece (7 Nov 2025) describes Chinese manufacturers racing to dominate European roads, using the UK as a key entry point and leveraging lower costs. (The Guardian)

- Very relevant for your “Chinese/Korean EV invasion” angle and future pricing pressure on VW/Volvo/BMW etc.

🌏 Asia (China, wider Asia)

- China & Asia still drive global growth – H1 2025 reports referenced in Nov

- EV Wire / EV Boosters:

- Global BEV sales H1 2025: 5.93 million (+29.1% y/y).

- Europe: 1.19 million EVs (+24.9%), 17.5% market share.

- China still holds the largest share; Asia overall is the main growth engine. (EVBoosters)

- EV Wire / EV Boosters:

- “Asia’s Electric Vehicle Revolution” – policy + industry push

- Overview article (not strictly November, but cited in current discussions) summarises how China, Japan, South Korea have aggressive EV policies, industrial strategies, and charging rollouts to support domestic OEMs and battery manufacturers. (asiangeo.com)

- This underpins why Chinese brands can undercut on price in Europe/Nordics.

(Most strictly date-stamped “Asia only” EV news in early November is embedded in global sales pieces rather than standalone stories.)

🇺🇸 United States

- U.S. vehicle sales fall as EV subsidies expire (Reuters, 4 Nov 2025)

- U.S. light-vehicle sales dropped in October as federal EV subsidies expired, reducing demand for BEVs.

- Tariffs and a softer labour market could further limit EV recovery in 2025. (Reuters)

- EV market share slipping slightly but still higher than 2023

- Recent U.S. data: BEV share ~7.4% of new car sales in Q2 2025, slightly down from 8.0% a year earlier, and essentially flat vs Q1 2025. (CarEdge)

- EV sales down, interest not dead (J.D. Power, 7 Nov 2025)

- J.D. Power: EV sales are under pressure in the U.S., but consumer interest is still growing, especially among existing EV lessees coming back into the market. (J.D. Power)

- Toyota goes big on U.S. batteries – but doubles down on hybrids

- Toyota announces a $14 billion battery plant in North Carolina, its largest U.S. battery investment.

- Batteries will support both EVs and hybrids, aligning with Toyota’s strategy to push hybrids (including PHEVs) as a more realistic mass solution vs pure BEVs in the near term. (Wall Street Journal)

- Tesla launches $60/day rental program as U.S. sales slump

- With U.S. EV sales down and the federal $7,500 credit gone, Tesla is piloting short-term rentals (~$60/day in California) including free Supercharging + FSD (Supervised) to move inventory and convert renters to buyers. (New York Post)

- Signals a more creative sales model and pressure on margins.

🌍 Global cross-region story (touches EU/Asia/US)

- Global EV sales booming, North America lagging

- Carscoops summary (Nov 2025): global EV and PHEV sales remain strong and are expected to stay high in China and Europe, while North America is the outlier with a clear slowdown. (Carscoops)

9th of November 2025

Here’s a detailed update on the EV-landscape, covering the upcoming Volvo EX60, the situation in Germany, and key developments in Asia (China, Korea, Japan).

1. Volvo EX60

Key points

- Volvo has announced the EX60 as its next-generation mid-sized electric SUV, positioned to sit beneath the current large EVs and above smaller models. (TopElectricSUV)

- It will be the first vehicle built on Volvo’s new “SPA3” architecture, purpose-designed for EVs (rather than adapted ICE platforms). (TopElectricSUV)

- Some of the technical/spec highlights announced or reported:

- 800 V architecture for faster charging. (What Car?)

- A potential range around ~300-350 miles (≈480-560 km) according to EPA/estimates. (TopElectricSUV)

- Up to ~400 kW system power (≈536 hp) for performance variants. (TopElectricSUV)

- Reduced cost/cost-efficiency focus: the car is intended to be priced “like a plug-in hybrid” (rather than ultra-premium EV) while improving margins. (motorillustrated.com)

- Manufacturing innovations: cell-to-body (CTB) battery integration, megacasting of large body components to reduce complexity and cost. (TopElectricSUV)

Timing & markets

- The global debut is scheduled for 21 January 2026. (TopElectricSUV)

- Production should start during H1 2026 with roll-out following; U.S. market among early ones. (TopElectricSUV)

- Volvo is offering incentives to smooth adoption: e.g., 1-year free home charging in some markets ahead of the launch. (Yahoo Autos)

Implications

- For you (given your interest in property/EV integration): the EX60’s faster charging and home-charger incentive could make it an interesting option near or post-2026 for integration into your home setup (heat-pump, PV, smart charging etc.).

- From a market-perspective: Volvo is signalling that EVs must become cost-competitive with internal-combustion or PHEV models, not only technologically superior, which is an important shift.

2. Germany / European market situation

Market trends and developments

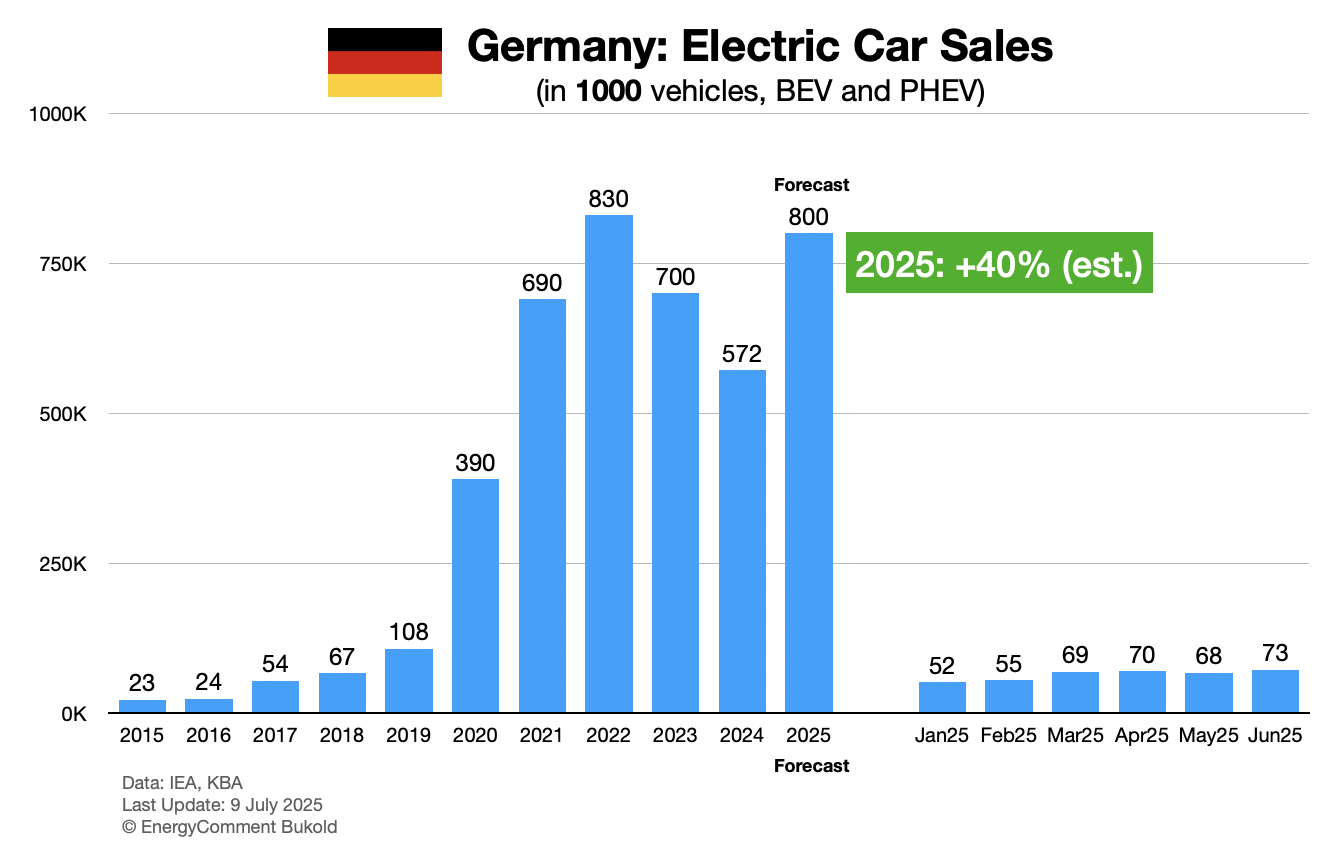

- Germany’s EV market (both BEV and PHEV) continues to grow: In September 2025, plug-in models had a 31.1 % share of new registrations in Germany, with volumes up 48.1 % year-on-year. (Autovista24)

- For the first nine months of 2025, BEVs accounted for 18.1 % of new registrations in Germany—slightly above the EU average. (english.news.cn)

Challenges & competitive shifts